Impacts of Superannuation Changes on Personal Injuries Damages 2023 Update

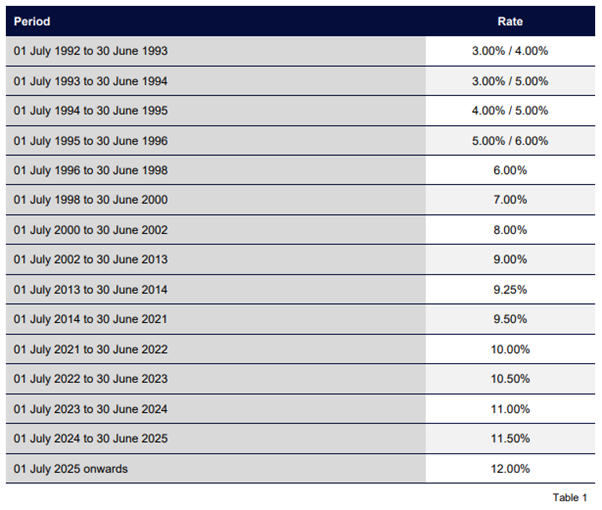

Contribution Rate:

The rates of compulsory employer sponsored superannuation support:

The approach adopted by the Courts since the previous changes:

The Courts would appear to have continued to adopt a “rule of thumb” approach but used a variety of differing rates.

As noted in previous papers in the Queensland Court of Appeal decision of Heywood v Commercial, Electrical Pty Ltd [2013] QCA 270 the Court took the approach of allowing superannuation at a rate of 11.33%.

The Court appears to have considered the increased rates of employer sponsored superannuation contributions as set out in the Superannuation Guarantee (Administration) Amendment Act 2012 (Cth) and also “the five per cent multiplier tables and the deferred aspect of the above rates”.

In most instances the approach appears to fall into the following categories:

- The Heywood “rule of thumb” being 11.33%

- The modified Heywood “rule of thumb” where the rate is modified depending on the claimant’s age at the date of trial and the number of years until retirement.

Since July 2022 the Courts would appear to continue to use both approaches:

- Norsgaard v Aldi Stores (A Limited Partnership) [2022] QDC 260 adopting actual rates on past losses and 11.82% on future losses.

- Mason v State of Queensland [2023] QDC 80 adopting 9.5% on past losses and 12% on future losses.

- Nkamba v Queensland Childcare Service Pty Ltd [2022] QDC 292 adopting 9.5% on past losses and 11.33% on future losses.

- Amos v Miki Stowers t/as Essy Tree Lopping Services [2023] QDC 127 adopting 9.5% on past losses and 11% on future losses.

- Chapman v Wide Bay Hospital and Health Service [2022] QDC 271 agreed 9.5% on past losses and 10.5% on future losses.

Rule of Thumb Approach:

The “rule of thumb” approach provides for a convenient and simple method of assessment, in nearly all circumstances it leads to over or under compensation due predominantly, to the variance in tax rates applying to income and superannuation.

A Possible Queensland Approach:

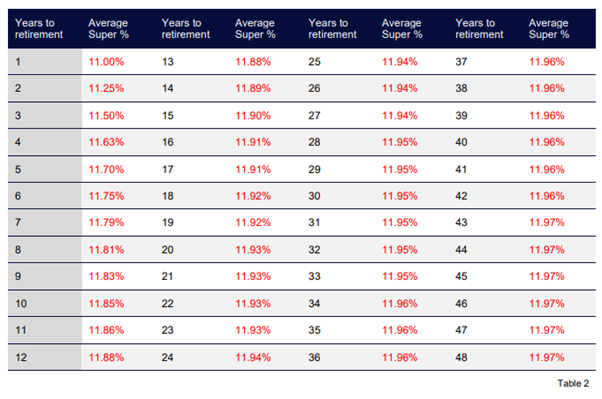

With the changes in mandated percentages the “rule of thumb” as applied will need to be amended to reflect varying future rates. The following table provides a guide to the future “weighted” average percentage that may be appropriate for varying periods of years until retirement (as at August 2023).